maryland ev tax credit 2022

Electric vehicle excise tax credit the limitation on the maximum total purchase price 6 of certain electric vehicles. With the renewed Alternative Fuel Vehicle Refueling Property Tax Credit businesses can again receive a 30 tax credit up to 30000.

![]()

Incentives Maryland Electric Vehicle Tax Credits And Rebates

Under the proposed Clean Cars Act of 2021.

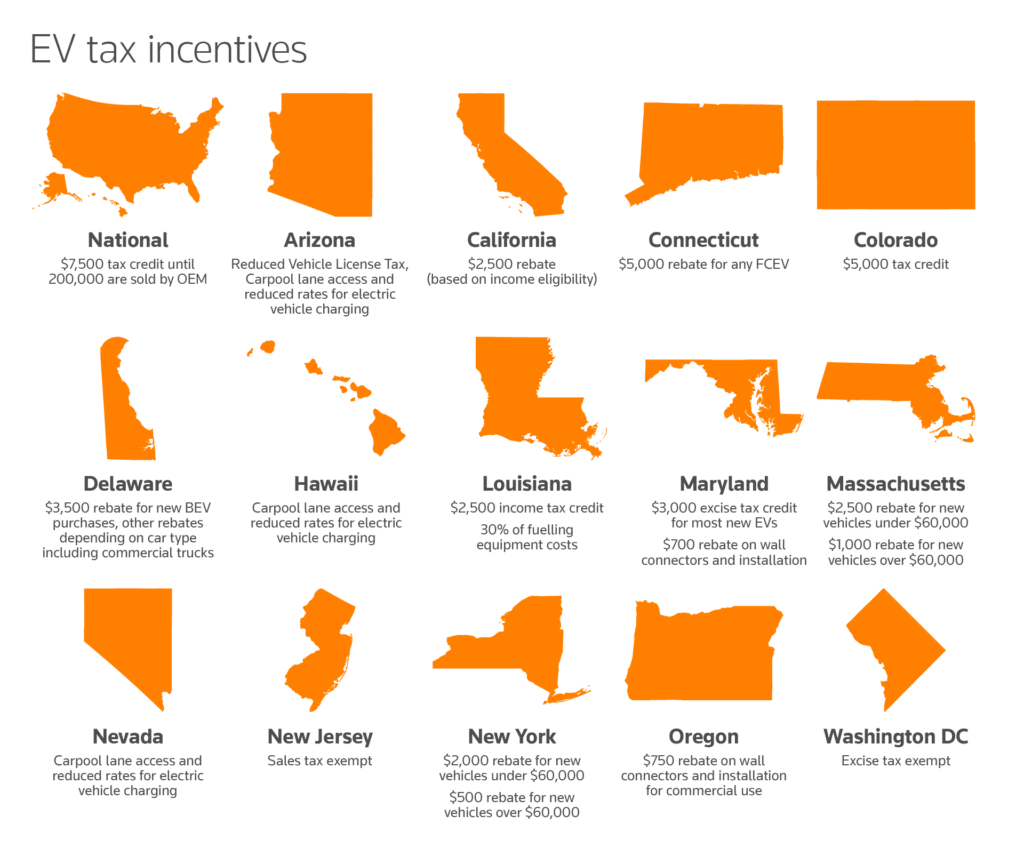

. Maryland Energy Storage Income Tax Credit - Tax Year 2022. You may be eligible for a one-time excise tax credit up to 3000 when you purchase a qualifying zero-emission plug-in electric or fuel cell. Yes there is a Maryland EV tax credit for electric vehicles as well as a home charger rebate incentive.

Taxpayers are eligible for a credit of 30 of the hardware and installation costs for EV chargers installed in their homes after December 31 2021. Colorado Plug In Electric Vehicle Tax Credit Applies to purchased leased or converted vehicles. Introduced and read first time.

Stephen Edelstein October 6 2022 Comment Now. Contact MEA regarding Maryland. You can find us at 1770 Ritchie Station Court in Capitol Heights MD.

Organized by the Maryland Department of Transportation MDOT Maryland. Up to 26 million allocated for each fiscal year 2021 2022 2023. The ev tax credit.

The Alternative Fuel Infrastructure Tax Credit. Maryland Excise Tax Credit up to a maximum of 3000 for Electric Vehicle or Plug. February 15 2022.

Tax Credits and Deductions for Individual Taxpayers. The Renters Property Tax Credit Program similarly provides tax relief for eligible renters who pay high monthly rent relative to their total income. The maryland energy administration mea has opened the application period for the tax year 2022 ty 2022 maryland energy storage income tax credit program.

Expires January 1 2026. Theres a standing 7500 federal tax credit on qualified new electric vehicles and a reduced credit for many new hybrids. Federal Income Tax Credit up to 7500 for the purchase of a qualifying Electric Vehicle or Plug-in Hybrid.

The Internal Revenue Service IRS and US. The total amount of funding currently available for this rebate program in state fiscal year FY 2022 7122- 63023 is up to 1800000. Maryland student loan tax credit deadline.

Treasury Department are seeking public comment on draft rules for the revised. The tax credit is available for all electric vehicles regardless of make or model and. A new tax credit worth a maximum 4000 for used electric vehicles would be implemented.

Maryland EV is an electric vehicle education and outreach resource serving Maryland and the Mid-Atlantic. And received authorization to operate from the local electric utility in Tax Year 2022 is. This is a one-time.

The majority of recipients of. The First-Time Homebuyer Savings Account Subtraction may be claimed on Form 502SU by a Maryland resident who has not. Establishing the Medium-Duty and Heavy-Duty Zero-Emission Vehicle Grant Program for certain vehicles and equipment to be administered by the Maryland Energy.

Maryland Electric Vehicle charging tax rebates. First and foremost for EVs placed into service after December 31 2022 the. To learn more about 2022 EV tax incentives and benefits in Maryland drop by Pohanka Hyundai.

Between our federal electric vehicle tax credit breakdown and the details above. The Maryland Energy Administration MEA has opened the application period for the Tax Year 2022 TY 2022 Maryland Energy Storage Income Tax Credit Program. Oregon Charge Ahead Plug-In Electric Vehicle.

An official website of the State of Maryland. Would apply to new vehicles purchased on or after July 1 2017.

Maryland Electric Vehicle Home Facebook

-Alt-FI.jpg?t=1659390250&width=826)

States File Plans On Deadline For Federal Ev Charging Funds Rto Insider

Federal Ev Tax Credit Explained Youtube

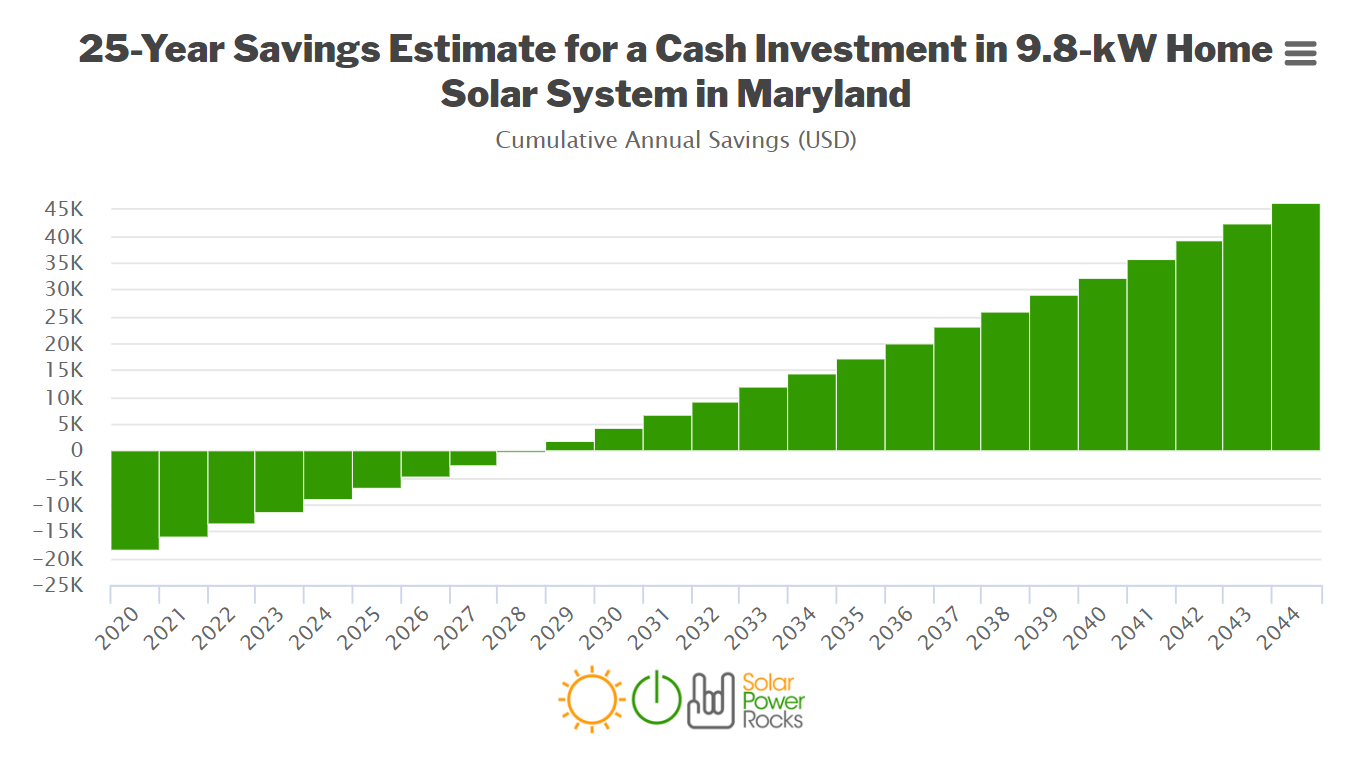

Solar Rebates Renewable Energy Incentives For Maryland Alte

![]()

Incentives Maryland Electric Vehicle Tax Credits And Rebates

The New Ev Tax Credit In 2022 Everything You Need To Know Updated Yaa

2022 Ev Tax Incentives And Benefits In Maryland Pohanka Volkswagen

How To Claim Your Federal Tax Credit For Home Charging Chargepoint

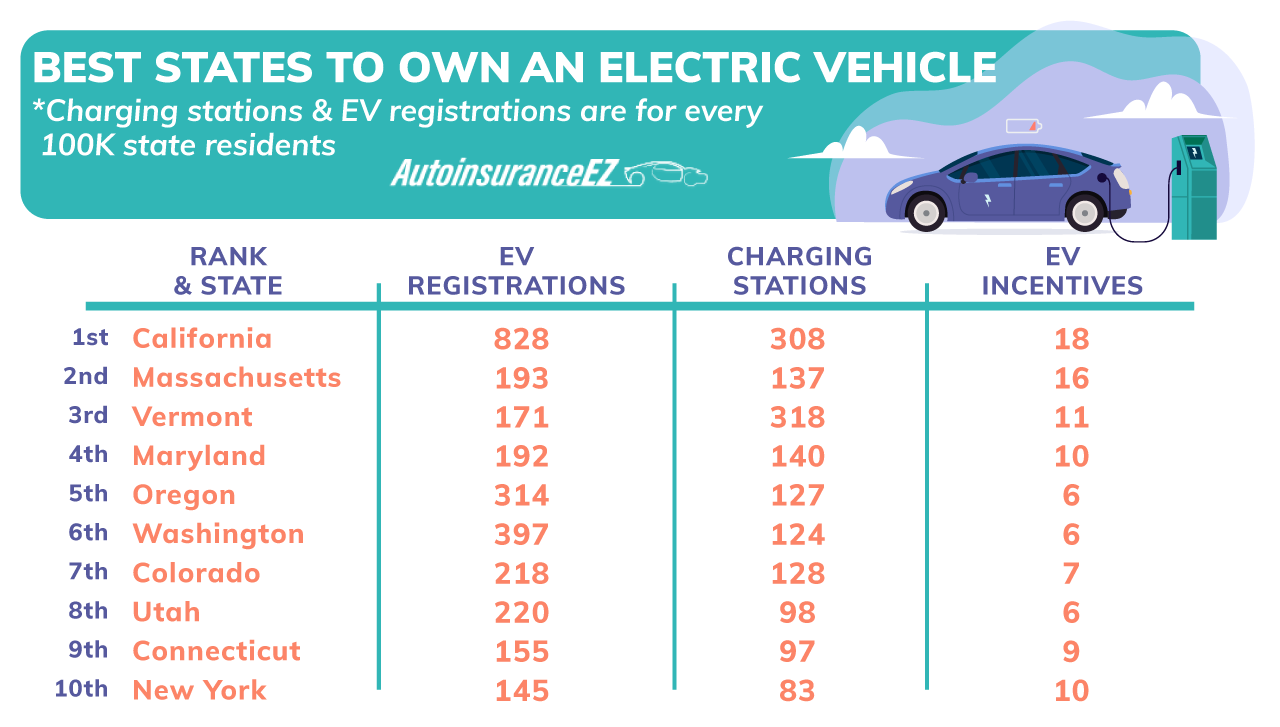

10 Best States To Own An Electric Vehicle 2022 Study Autoinsuranceez Com

Toyota S Federal Ev Tax Credits Are All Dried Up

Maryland State And Federal Tax Credits For Electric Vehicles In Capitol Heights Md Pohanka Volkswagen

Biden S Ev Tax Credits Are Available To Only 21 Vehicles Unik Infotech

Ev Tax Credit 2022 Updates Shared Economy Tax

How Do The Ev Tax Credits In The Inflation Reduction Act Work

2022 Ev Tax Incentives And Benefits In Maryland Pohanka Hyundai Of Capitol Heights

Most Electric Vehicles Won T Qualify For Federal Tax Credit Maryland Daily Record

Most Electric Vehicles Won T Qualify For The Tax Credit That S In The Inflation Reduction Act Nbc4 Washington

.jpg)